Did you know you can sell all or a portion of a life insurance policy, even term insurance?

(3 minute read)

Did you surrender a life insurance policy for cash value recently and received a form in the mail? That was probably a 1099-R, a tax form sent out by your insurance company. If you’re confused about this piece of mail, don’t fret! We’ll take a look at what exactly it is and how it could potentially impact your taxes.

What is a 1099-R?

A 1099-R is simply a form that is sent out because of a potentially taxable event. Insurance companies are required to send these forms out whenever something happens to trigger it, like a full surrender of a life insurance policy, a partial withdrawal, a loan, or a dividend transaction. These forms can also be sent in for annuities as well. If you’re unsure why you are receiving this form, consult your tax advisor to find out why this came in the mail for you.

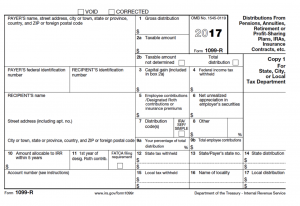

What does a 1099-R look like?

The 1099-R form looks like this (with the applicable year on it):

What does it mean to surrender a life insurance policy?

Surrendering a life insurance policy means that you have agreed to take a cash payout in return for forgoing the death benefit. The insurance company assigns a value to your policy and that is the amount that you will receive upon surrender.

Depending on the type of policy you hold and how long you’ve had it, you may receive a large amount of cash value or you may not receive much at all. Surrendering a policy rids you of your monthly premium and can potentially mean receiving a sum of money that can be used for other investments or necessities. However, remember that this money can have implications for your taxes, and there may be other options available where you can net more cash than with a surrender.

What are the tax consequences of surrendering a life insurance policy?

With that 1099-R form, you may be wondering: are the cash value proceeds from a surrendered life insurance policy taxable? The answer is yes, you can generally expect a tax on the amount of money you received minus the policy basis. These taxable gains on life insurance policies can add to your tax burden, so you should consult a tax advisor before surrendering your policy. In addition to the tax on surrender of life insurance policy, you may also have some fees depending on the type of policy you hold.

Do I have to pay taxes on a 1099r?

It depends on the reason why you are receiving the 1099-R. If it is from surrendering a life insurance policy or a non-qualified annuity, your form will show the taxable amount in Box 2a. If your 1099-R does not have a number in Box 2a, you most likely do not have to pay any taxes.

How do you determine the taxable amount on a 1099R?

Your taxable amount will be reflected on the form, but if you want to determine how much you will owe from the surrender beforehand, the calculation is fairly simple. To calculate the taxable amount, the formula is:

(Net cash surrender value) – (premiums you paid) = (taxable amount)

For example, if you owned a whole life insurance policy with $300,000 in cash value, and you paid $120,000 in total premiums, your calculation would be:

$300,000 – $120,000 = $180,000

This amount should be reflected in Box 2a on your 1099-R. Be sure to double check everything and consult with your tax advisor if you think there are any errors or issues with your form.

Is there an alternative to surrendering a life insurance policy?

Yes, another option you may want to consider is a life settlement. Essentially, you can treat your life insurance policy like any other asset you own – house, car, boat – and sell it to a life settlement company in exchange for cash. You will receive the cash payout, and the investor keeps the policy by paying the premiums and receives the death benefit when the original policyholder dies. A policy’s value on the secondary market is typically four to eight times its cash surrender value.

To learn more about life settlements and see if you might qualify, visit our life settlement calculator. I am also happy to answer any and all questions about these life-transforming transactions.

Leo LaGrotte

Life Settlement Advisors

llagrotte@lsa-llc.com

1-888-849-0887