Did you know you can sell all or a portion of a life insurance policy, even term insurance?

(6 minute read)

Can you cash out a life insurance policy before death? Yes, surrendering or selling a life insurance policy can be extremely beneficial if you cannot afford the premiums, are in urgent need of financial assistance, or you simply want to allocate those funds elsewhere. Whatever your specific situation might be, there are ways to rid yourself of a policy that is either fiscally burdensome or no longer needed.

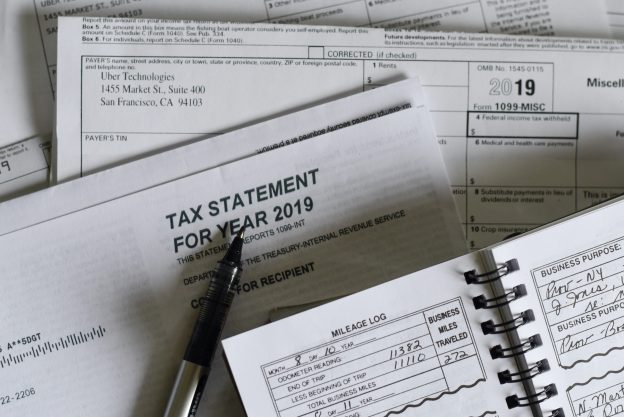

But are the proceeds from the sale of a life insurance policy taxable? In short, yes there are tax consequences of transferring ownership of a life insurance policy and for surrendering a life insurance policy.

So, how exactly are life insurance proceeds taxable? And do you pay taxes on life insurance cash out in all circumstances? Although each situation is different, there are general guidelines and taxation rules you should be aware of before discarding your insurance policy. In this guide we will discuss how life insurance payouts are processed and taxed after a life insurance policy is sold or surrendered, and arm you with the information you need to make the right decision.

What Are Taxable Gains for Life Insurance Policies?

Firstly, we’ll discuss what taxable gain is and how it applies to cash surrenders and life settlements. In simple terms, the taxable gain is defined as the exact dollar amount you receive from cashing in or selling your life insurance policy after the premium payment or payments you paid into your life insurance policy have been deducted. It should be noted that this only applies to life insurance policies with a cash value that are being canceled or sold before the death of the insured.

Which Insurance Policies Have Cash Value?

As a rule, universal and whole life insurance policies both accrue cash value, making them ideal for life settlements and cash surrenders. However, the cash value of your policy depends on how long the policy has been active and the specific terms of your individual contract. In all cases, surrendering or selling your life insurance policy have two significant benefits:

- You no longer have to pay your monthly premium.

- You receive a fairly large sum of money to use for emergencies, necessities, or investments.

Does Life Insurance Cash Value Count as Income?

Life settlement and cash surrender proceeds are both treated as ordinary income and capital gains. For each option, the net proceeds from the actual transaction will be treated as ordinary income while the amount paid into your premiums will be treated as capital gains. Both ordinary income and capital gains are taxed differently, therefore it is important for you to consult with a tax advisor to ensure that everything is in order on your end. We’ll get into the specifics of the taxation processes for surrendering and selling your life insurance policy a little later in this article.

What Happens When a Policy Is Surrendered for Cash Value?

Surrendering your life insurance policy involves working with your insurance provider to cancel your coverage, meaning you are no longer responsible for paying insurance premiums and are entitled to receive cash for your policy. The precise cash surrender value of your life insurance varies depending on your personal life insurance policy, but the general process of surrendering your life insurance policy is standard across the board. When you decide to follow through with a full surrender, you agree to take the cash surrender amount that was assigned to your policy and renounce your death benefit. It’s also worth mentioning that you will always receive a better payout from a life settlement compared to surrendering your life insurance policy. Therefore, if you qualify for a life settlement, it makes more financial sense to pursue that route. However, we will get into the details and qualifications of life settlements later on in this article.

However, there are a few conditions to account for when surrendering a life insurance policy.

- How Long You’ve Had Your Policy: If your policy is fairly young, you may be charged surrender fees, which are taken out of your cash surrender payout.

- The Cash Amount of Your Policy: Although death benefits of insurance policies are tax-exempt, the cash you gain from surrendering your policy is counted as taxable income. That is why it’s extremely important to consult with a tax professional before surrendering your life insurance policy.

What Are the Tax Consequences of Cashing in a Life Insurance Policy?

Regarding the surrender of a life insurance policy, your cash surrender value is viewed as regular income, making it subject to a marginal rate of taxation. After surrendering your insurance policy, you will be taxed based on the amount you received minus the policy basis. Your taxable amount is intended to reflect your investment gains. You will also be charged additional surrender fees, which will phase out eventually. However the specific time-frame depends on your policy holder.

What Happens When a Policy Is Sold Through a Life Settlement?

Unlike surrendering your life insurance, a life settlement involves selling all or a portion of your policy to a third-party for a one time cash sum. The cash payment you receive from a life settlement will always be more than the cash-surrender value but will be less than the death benefit your family would receive if you kept your policy.

After you sell your policy to a third-party, they will become your policy’s beneficiary and will pay your remaining premiums. In return, they receive your death benefit.

However, not everyone can go through with a life settlement. There are a few qualifications that need to be met to successfully sell your life insurance policy. Here they are in detail:

- Your Policy Type: Your policy must be at least two years old and can be a universal life, whole life, second-to-die, or convertible term policy.

- Your Policy Size: Your death benefit has to be worth a minimum of $100,000 to qualify.

- Your Age: You must be 65 years of age or older to qualify for a life settlement.

- Your Life Expectancy: Individuals with a life expectancy of 15 years or less are candidates for a life settlement.

- Your Premium Amount: If your monthly premium is lower, then a buyer will be more likely to purchase your policy.

What Are the Tax Consequences of a Life Settlement?

The tax consequences associated with life settlements are fairly similar to cash surrenders. When choosing a life settlement, your premiums are your basis in the policy and are not taxed. However, you will pay taxes on any amount you earn that exceeds the premiums you have paid. Let’s explore some examples and see what this looks like in practice.

How Much Tax Do You Pay on a Life Insurance Payout?

We know all of this sounds very complex. In an effort to provide more clarity, here is an example of what the taxation process looks like for both a life settlement and a cash surrender.

Life Insurance Surrender Example

If you paid $50,000 in premium payments on your policy until you surrendered it, and your policy accumulated a $55,000 cash surrender value, then the $5,000 difference is the amount that is taxable.

Life Settlement Example

If you paid $50,000 in premiums and received a $65,000 life settlement, you would need to pay taxes on the $15,000 difference.

In both cases, working with a financial advisor can help you plan for these taxes and ensure that everything is in order.

Why Choose a Life Settlement?

As we mentioned before, choosing a life settlement over surrendering your policy will always put more money in your pocket. Additionally, life settlements are very safe investments— if you meet the established requirements, you are guaranteed a pay out.

Although to achieve the most beneficial results, it’s critical to choose a trustworthy and transparent third-party broker. With 55+ years of combined experience in this field, Life Settlement Advisors can be your trusted confidant throughout this process. It’s our mission to properly educate you about the life settlement process and ensure that you have all of the information you need to make the best decision for you and your family. If you are interested in learning more about the qualifications for selling your life insurance policy, or are interested in learning how to apply, you can either watch our helpful video or reach out to us directly.

Did you know you can sell all or a portion of a life insurance policy, even term insurance? Selling an unwanted life insurance policy is no different than selling your car, home or any other valuable asset that will create immediate cash. Contact us today to learn more.

Get in touch with Life Settlement Advisors today to take the first step toward converting your policy into cash.

I am always happy to answer any questions about these life-transforming transactions.

Leo LaGrotte

Life Settlement Advisors

llagrotte@lsa-llc.com

1-888-849-0887